Why Smart Doctors and Dentists Are Bringing Back Real Pensions

If you own a medical or dental practice, you already know how to take care of everyone else’s health — but what about your own financial health?

Most of the doctors and dentists I meet have their savings split across a 401(k), maybe an IRA, and whatever’s left after taxes. That’s fine for employees — but not for practice owners. You’re running a business, building a legacy, and employing people who rely on you.

That’s why so many of my clients are turning to something that used to be standard: the defined-benefit pension.

What a Defined-Benefit Plan Really Does

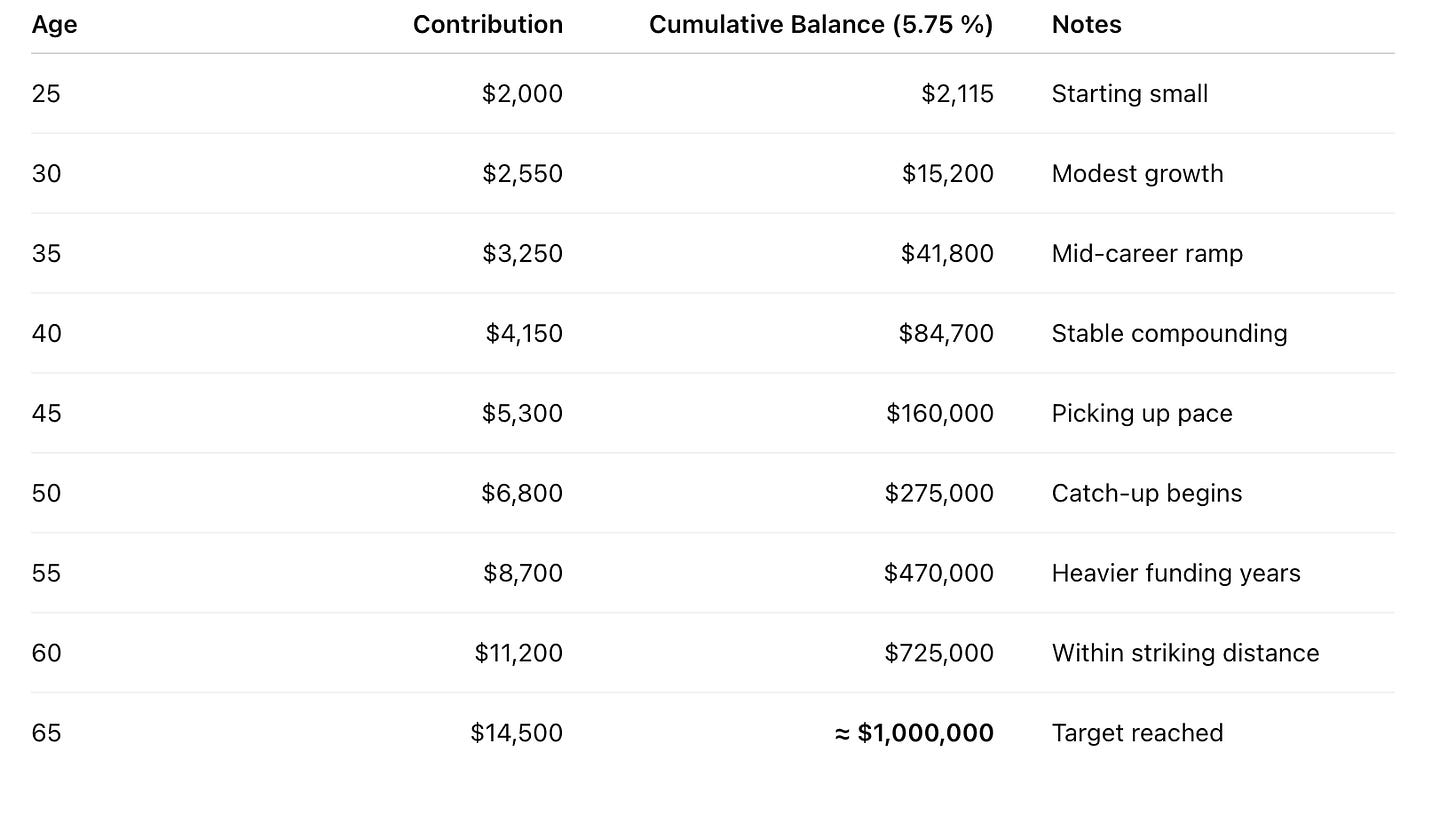

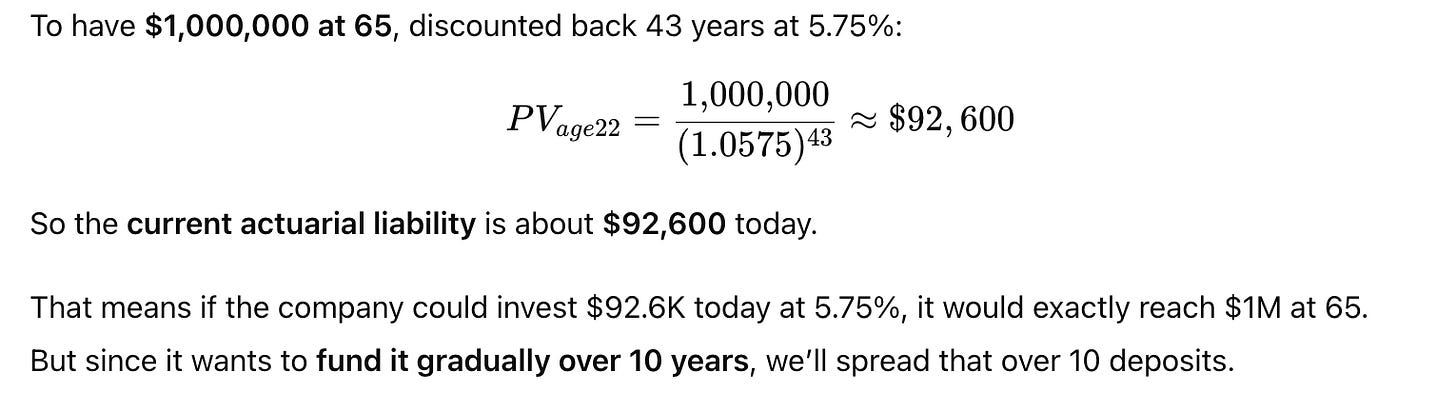

In plain English, it’s a retirement plan where you decide what you want out at the end, and we design a schedule of contributions that gets you there — safely and predictably.

Instead of guessing how the market performs, your pension is actuarially calculated to hit a specific goal. You can even insure it with the PBGC, the same federal agency that backs corporate pensions.

Here’s the part doctors love most:

✅ Every contribution is 100% tax-deductible to the practice

✅ The money grows tax-deferred

✅ And the plan can be funded in as little as 10 years

“It’s Not About Chasing Markets — It’s About Building Certainty”

“Most of the physicians we work with aren’t looking for risky returns,” says Robert Mowry, Partner at Del Mar Medical Pensions.

“They’re looking for peace of mind — to know that if they take care of their patients and their team, their own retirement will take care of itself.”

Why It’s Also a Powerful Retention Tool

Turnover hurts more than just your schedule — it erodes culture and productivity.

In healthcare and dentistry, staff often move every couple of years for a slightly higher wage or a new benefit.

A defined-benefit pension changes that dynamic. When employees see a real, guaranteed retirement benefit, they stay.

“We’ve watched offices cut turnover in half just by adding a pension,” says Mowry.

“A PBGC-insured benefit sends a message: you have a future here.”

The Tax Win Most Practices Miss

Every dollar you put into the plan is deductible to the practice — meaning it comes straight off your taxable income.

You can finally pay yourself first, without sending so much to the IRS.

And because the money grows tax-deferred, compounding works even harder for you.

When structured correctly, the plan benefits you, your team, and the tax code — all at once.

The defined-benefit plan isn’t some relic from the past — it’s a powerful, tax-efficient financial strategy that still works perfectly for modern medical and dental practices.

If you’re profitable, paying too much in taxes, or struggling to keep great staff — this is the one benefit that solves all three problems at once.

Del Mar Medical Pensions

Designing PBGC-insured, tax-advantaged pension plans for physicians, dentists, and biotech executives across California.

📩 To request a custom pension illustration for your practice, subscribe to this Substack and we’ll reach out!