Unlocking Life Science Innovation: Investor Reflections on Phase Two Ventures’ Journey

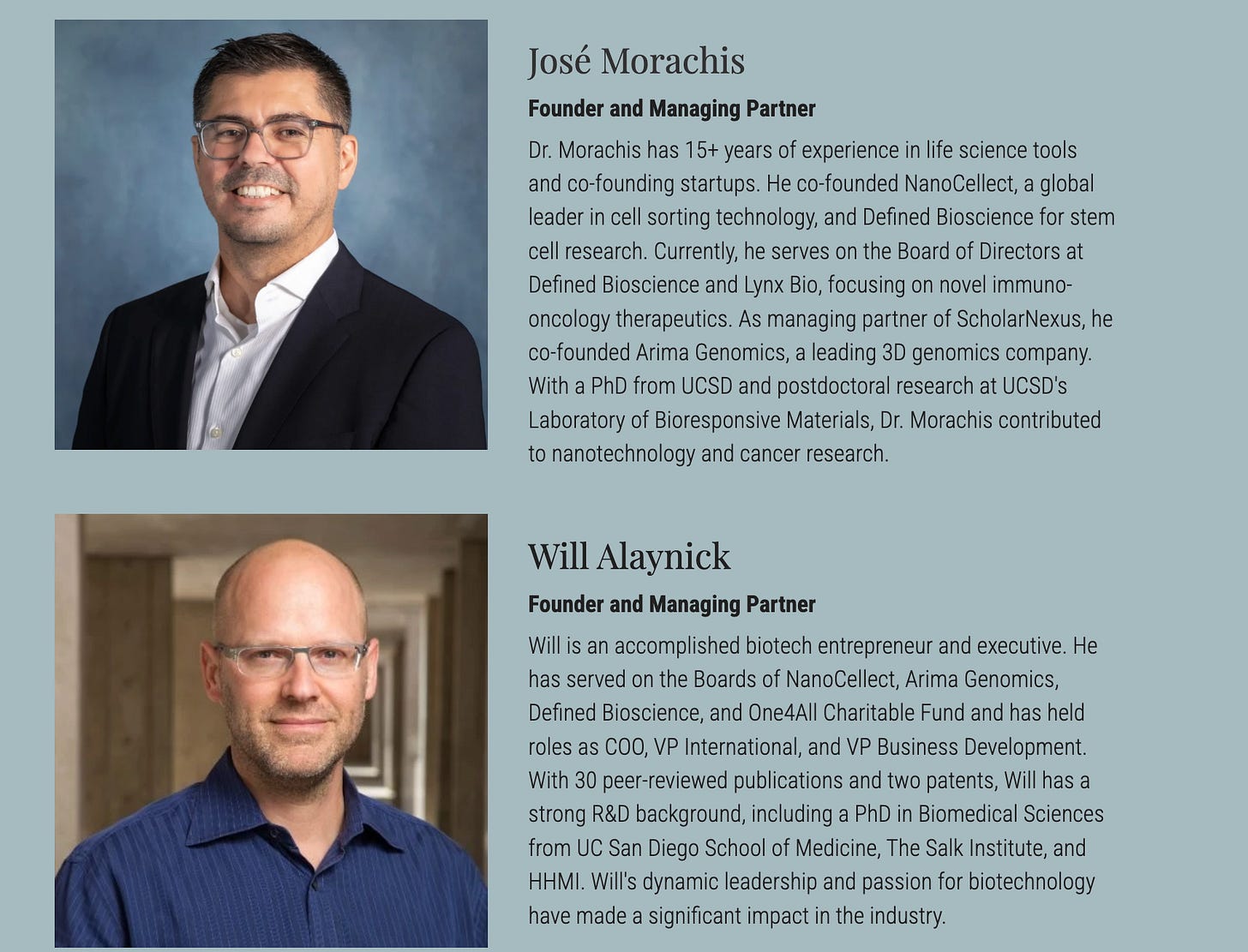

The recent interview on the “Bizzy Scientists” podcast, featuring Dr. Jose Morachis and Dr. Will Alaynick—the co-founders of Phase Two Ventures—serves as a masterclass in the art of turning scientific genius into investable opportunity, especially within the fertile grounds of San Diego’s innovation ecosystem.

Every compelling entrepreneurial story starts with an inflection point—a moment where scientific curiosity meets the realization of a bigger impact. For Will and Jose, their journey, as recounted in the interview, exemplifies how life science breakthroughs are often cultivated by people whose career beginnings were far removed from business, yet whose personal stories and serendipitous encounters became the catalysts for transformation.

Jose’s initial ambitions lay on the basketball court, a far cry from the pipettes and journals of biomedical research. Yet, like many in the sciences, fate—disguised as poor eyesight and an inspiring biology teacher—redirected his path. This transition, combined with powerful personal experiences (such as supporting a roommate battling colon cancer), provided him with a motivating mission: to make an impact in cancer research and beyond.

Investors know that the best founders are driven by authentic passion and personal stakes. Will and Jose, through their formative experiences at the Salk Institute and UCSD, embody the archetype of founder resilience—shaped by adversity, relentless curiosity, and the courage to leap into the unknown.

Building Entrepreneurial Muscle: Learning by Doing

The leap from academic research to running a company is vast. This reality is clearly illuminated in the podcast, as the founders recount the origins of Scholar Nexus—a consulting company born out of a graduate school club. The narrative is relatable for anyone who has attempted to build something from scratch with little more than ingenuity, camaraderie, and $200 in pooled funds.

The early days are not glamorous—cold starts, failed fundraising, and the humbling experience of having to “figure it all out” without a safety net. Investors should pay close attention to these stories, as early failure forges wisdom and adaptability—the qualities that most often separate enduring ventures from the field.

A particularly telling episode is their involvement in launching the San Diego Science Festival. This not only underscores the team’s resourcefulness and ability to mobilize, but also highlights their commitment to the wider science community—a value that bodes well for building networks, securing future talent, and navigating local innovation ecosystems.

Bridging Science and Commercialization: Formation of NanoCellect

From the perspective of a life science investor, the most crucial moments are those where pursuit of impact converges with sharp commercial acumen. The transition from Scholar Nexus to the formation of NanoCellect marks precisely this juncture.

NanoCellect’s origin story is a textbook example: an opportunity sourced from a university lab, a founding team with complementary skillsets in biology, bioengineering, and business, and an urgent market need—streamlining and democratizing cell sorting through advanced microfluidics. What sets this apart from countless other university spin-outs is the founders’ alacrity in validating the technology, building relationships with key mentors, and rapidly securing non-dilutive funding (SBIR grants) to build their runway.

As an investor, several important lessons surface here:

Value of Multidisciplinary Teams: The success of early-stage ventures, particularly in life science, hinges on the ability to integrate technical expertise across biology, engineering, and business. Investors would do well to seek out teams that foster this multidisciplinary synergy from day one.

Bootstrapping and Non-Dilutive Funding: The team’s pursuit of SBIR grants demonstrates a keen understanding of capital efficiency and the strategic value of pushing technology readiness without immediate reliance on equity funding. This not only preserves founder ownership but also signals to prospective investors a defter hand at risk management.

Strategic Networks and Early Customers: The pivotal role of relationships in attracting Agilent as both an early adopter and investor cannot be overstated. Connections forged at community science festivals and within supportive university environments often open doors to transformative partnerships. Smart investors increasingly realize that backing founders with this networking savvy multiplies odds of commercial traction.

Diversity and Inclusion: Unlocking Broader Value

Throughout the interview, Will and Jose return repeatedly to the theme of diversity in science, innovation, and investment. This is not mere lip service; rather, it is an operational principle at Phase Two Ventures.

Diversity among entrepreneurs and investors is both an ethical imperative and a performance multiplier. Studies bear this out—funds and companies that prioritize gender and ethnic diversity routinely outperform their peers. The founders illustrate this with examples from their portfolio, such as supporting Lynx Bio and cultivating internship programs aimed at broadening representation.

For investors, the take-home is clear: rigorous attention to diversity and inclusion can unlock untapped markets, foster unconventional thinking, and ultimately deliver better financial returns. Phase Two’s intentional policies in this arena—ranging from recruiting women and minorities to leadership, to mentoring diverse founders—set them up as exemplars for the sector.

Pragmatism Meets Vision: What Makes a Quality Investment?

Will and Jose blend technical expertise with practical business sensibility—a duality that is often the “secret sauce” for successful life science investing. They highlight key investor considerations:

Is the technology not only innovative but commercially viable and scalable?

How robust is the intellectual property position?

Has the team demonstrated thoughtful customer discovery and go-to-market planning?

Are there clear, realistic milestones towards value creation (e.g., regulatory, reimbursement, manufacturing, commercial partnerships)?

One memorable anecdote is their pivot advising SweetSpot Diabetes, steering the founder from a direct-to-consumer approach (doomed by limited patient adherence) toward an institutional/kiosk-based solution, which led to acquisition by Dexcom. Such hands-on guidance, grounded in market realities, is precisely what life science investors should bring to their portfolio companies.

Building Phase Two Ventures: Community, Mission, and Long-Term Value

The culmination of these experiences forms the core mission at Phase Two Ventures: to bridge the gap for breakthrough innovations stuck between academic inception and commercial realization. The studio model they describe—melded with their investment practice—positions them not just as financiers but as co-builders and community architects.

Moreover, by focusing efforts regionally (in San Diego, a burgeoning hub), Phase Two can offer founders concentrated support, deep local networks, and resource-sharing, all of which de-risk early-stage bets and magnify returns on time, capital, and relationships.

Inviting the Next Generation: Open Doors and Open Minds

Perhaps the most energizing segment of the interview is the founders’ open invitation—to scientists with world-changing ideas, to students and postdocs, to would-be investors—offering them a place to turn curiosity into action, and ideas into companies.

For an investor, this open-door policy is a welcome sign. The future of life science innovation depends on lowering barriers, pooling diverse talents, and investing with intentionality in the people and technologies that will shape tomorrow.

Reflections

Listening to Will and Jose reminds me why I chose life-science investing in the first place. Every breakthrough—whether a diagnostic, therapy, or platform—extends far beyond financial returns; it transforms lives, strengthens communities, and reshapes entire industries. The path is rarely straight, and true progress is built as much on humility and persistence as on technical excellence.

Phase Two Ventures exemplifies what happens when smart capital partners with bold, capable teams in a collaborative ecosystem. Their story is a call to action—to keep investing in inclusivity, pragmatism, and community, and to keep fueling the “busy scientists” whose work will define the next generation of medicine and innovation.

Check out Will’s book!