Smart Pensions for Smart Doctors: Customizing the Climb to Retirement

Two clear mindsets define how doctors approach retirement: those who want to contribute aggressively now for compound growth to work its magic—and those who prefer to defer contributions until their peak earning years.

“Some doctors want to write the biggest check they can today because they’re thinking, ‘I’ve already climbed the mountain—I just want to lock in the view.’ Others are still climbing, and they know the biggest checks will come once the ascent flattens out.” — Robert Mowry, CIO, Del Mar Medical Devices

The ‘Stash Now’ Physician: Front-Loading for Freedom

These physicians, often in their 40s or early 50s, are laser-focused on putting away as much as possible. Many own practices, have stable referral bases, or work in high-earning specialties. Their strategy is rooted in a desire to front-load retirement, reduce taxes today, and de-risk their future.

Instead of tossing money into a 401(k) and expecting your star employee to somehow 5x it—adding pressure to become a stock market expert on top of doing their job—imagine saying: “Suzie, we’re contributing 6% of your salary to a defined-benefit plan—just like the one I have at the hospital. By age 30, you’ll be fully vested with more retirement income than Social Security.”

Compensation matters, but it’s stability that builds true retention.

The ‘Save Later’ Physician: Scaling With Income

Some expect their income to grow significantly in their late 50s and 60s. They want flexibility now and the option to make large contributions later—when business is booming or expenses (like children’s education or practice debt) decrease.

For example, Dr. Patel, a 38-year-old gastroenterologist, is currently focused on expanding his clinic and paying down student debt. But he has already designed a defined benefit plan that allows for catch-up contributions once his earnings scale in his 50s.

Customized Structures for Unique Trajectories

Defined benefit plans, especially those tailored to multi-participant groups, allow each physician to operate on their own financial timeline. This flexibility is key.

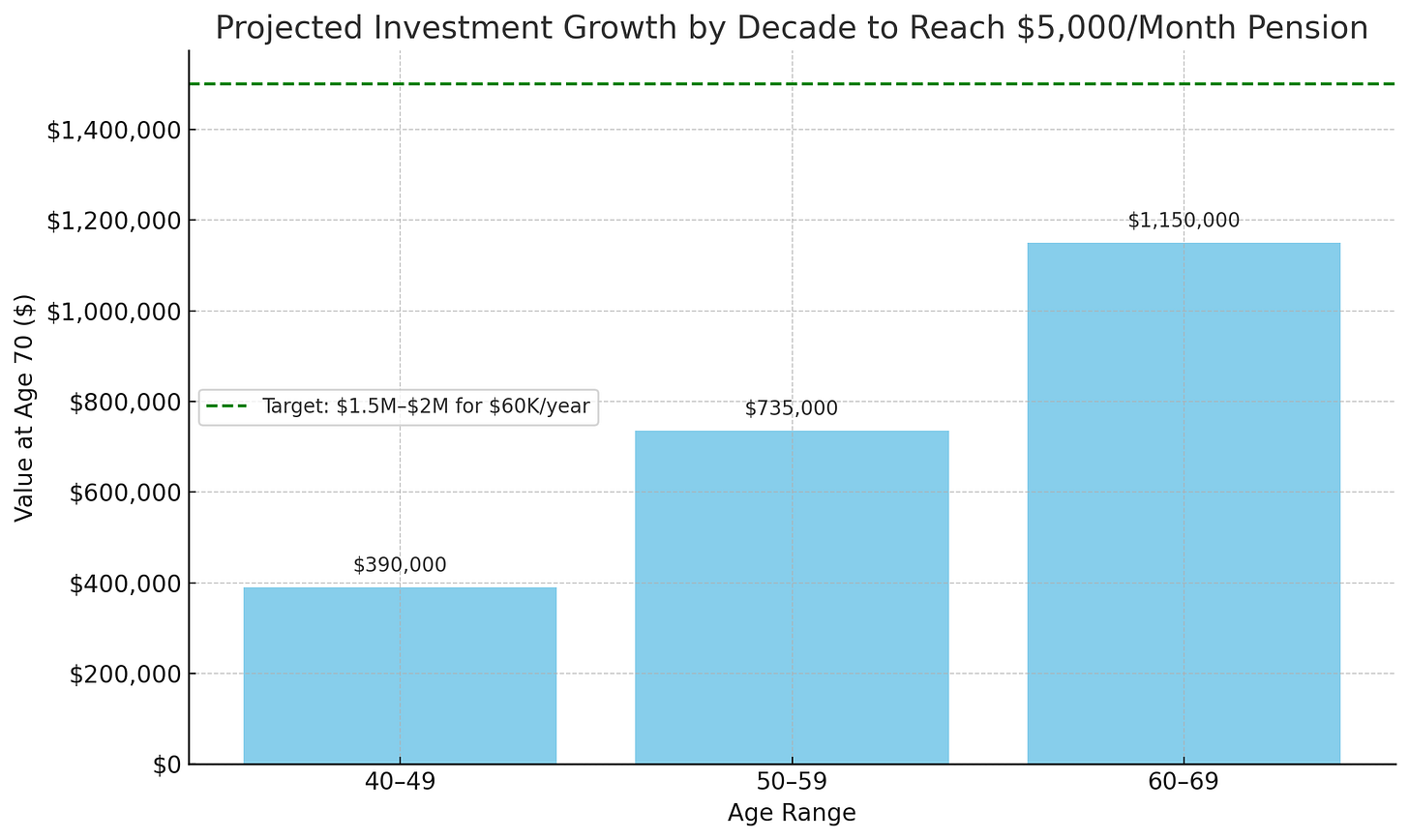

“One physician might be contributing $100K a year and feel set. Another may be focused on their home this decade, then plan to contribute $1 million between ages 60 and 70. A well-structured plan can adapt to either path.”

— Robert Mowry, CIO, Del Mar Medical Devices

Advisors Must Match Psychology to Structure

Understanding these two mindsets is essential for any financial advisor or administrator structuring pension solutions for medical professionals. The most effective plans meet the doctor where they are—whether it’s locking in security now or building a ramp for bigger contributions down the road.

Defined benefit plans are retirement vehicles and tax tools. Contributions are tax-deductible for the practice, and benefits are governed by IRS limits and actuarial calculations. Properly structured, these plans qualify for PBGC insurance, adding a layer of federally backed protection.

The most effective plans meet the doctor where they are—whether it’s locking in security now or building a ramp for bigger contributions down the road.

Whether you're at the summit or still climbing, the right pension design will grow with you—not against you. Strategic alignment between your income arc and contribution strategy is the real key to retiring both comfortably and confidently.

Del Mar Medical Devices is a life science trade association who does events, advocates for the San Diego region’s growth as a medical hub, and offers members defined benefit pension plans. Mr. Mowry is on the investment committee.