From Vision to Venture: Building San Diego’s Life Science Future, Together

On a warm evening in San Diego, over 75 founders, investors, scientists, operators, and connectors gathered for what was meant to be an intimate happy hour. Hosted by Phase Two Ventures and backed by generous partners like JLL and Cooley, the gathering swelled in size and spirit—fueled by shared conviction in San Diego’s place at the forefront of global life science innovation.

But this wasn’t just another panel or pitch night. “Fred and I were saying: screw the panel,” joked Jose Morachis, co-founder of Phase Two Ventures. “People just want to talk with each other and connect. So we made sure to leave room for more wine, more beer, and more time.”

That spirit—of unstructured conversation, high trust, and deep local ties—was the guiding principle behind the evening. And behind Phase Two itself.

Who Is Behind Phase Two?

Jose Morachis and Will Alaynick, both UC San Diego PhDs with roots in elite research and entrepreneurial science, launched Phase Two Ventures to serve one goal: accelerating early-stage life science innovation in Southern California by filling the region’s most critical gap—capital.

Morachis earned his PhD in Biochemistry and Molecular Biology from UC San Diego, and has since built and exited successful ventures in biotech. Alaynick completed both his PhD in Biomedical Sciences at the UC San Diego School of Medicine (with training at the Salk Institute) and a postdoctoral fellowship at The Salk Institute for Biological Studies, where he focused on developmental neurobiology of the spinal cord.

Together, they bring the rare combination of scientific depth and founder empathy. They’ve been in the trenches—grant writing, experiment troubleshooting, team-building—and they know how painfully undercapitalized breakthrough science can be in its earliest days.

That’s the gap Phase Two Ventures was created to fill: to support life science tools and platform technologies with early capital and experienced backing from operator-investors who truly understand the path from bench to bedside.

San Diego: An Undervalued Powerhouse

“San Diego is already one of the top three life science ecosystems in the country,” Jose noted. “What we’re missing is more early-stage capital and more creative structures to unlock it.”

The region is brimming with scientific talent. From institutions like UCSD, Salk, Scripps, and Sanford Burnham, to R&D hubs of established companies like Illumina, Neurocrine, and ResMed—San Diego has the talent, the infrastructure, and the track record. But seed and pre-seed capital lags behind.

“We’ve all seen it,” Jose said. “Amazing technologies being built in San Diego that end up moving to the Bay Area or Boston—not because the science is stronger there, but because the capital flow is.”

That’s what makes Phase Two different. Their model isn’t about outsourcing or flying in capital. It’s about building a vertically connected innovation engine within San Diego—one that serves founders, draws on community, and keeps companies planted in Southern California as they scale.

More Than a Fund: A Community Builder

“Part of the magic here tonight,” said Fred Grier, “is how interconnected this ecosystem is. You’re really only one introduction away from knowing everyone you need to know to build something big.”

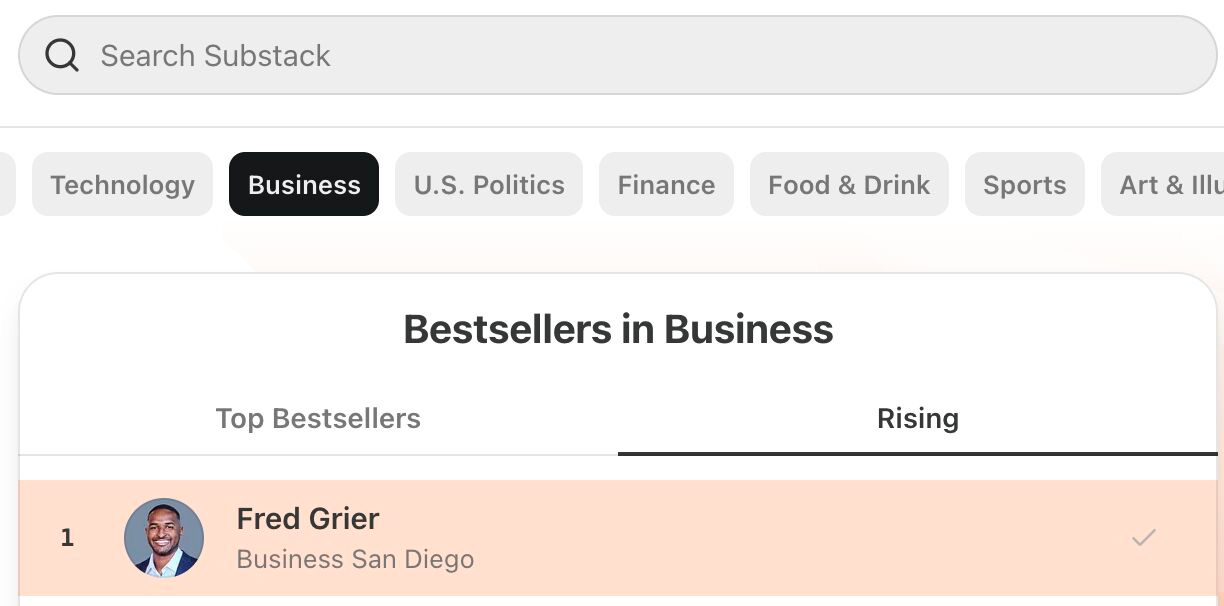

Fred would know. As one of San Diego’s leading business journalists and the founder of one the fastest-growing business Substacks on the West Coast, Fred has spent the past five years interviewing the most important founders, VCs, and operators across tech and biotech. But what he sees more and more isn’t just deal-making—it’s community-building.

“This event was about bringing together the people I’ve interviewed, and the people Jose and Will have backed or built with, to spark something bigger,” Fred explained. “No stage. No pitch decks. Just curated collisions and a belief in the long game.”

That belief is grounded in hard numbers. In 2021, San Diego saw nearly $10 billion in venture capital funding. In 2023, that dropped to about $4 billion—a national trend reflecting broader market contraction. But conviction in the region hasn’t wavered.

“If anything, moments like this are when smart capital and long-term builders really shine,” Fred added.

Why This Moment Matters

Early-stage investing in life sciences is not for the faint of heart. It’s messy, nonlinear, and typically far removed from quick exits. But it’s also where some of the most meaningful breakthroughs originate: diagnostic tools that catch diseases earlier, therapies that were once impossible, and platforms that shift how drug discovery is done.

And now, AI and computational biology are transforming the game.

“AI is becoming a big part of everything we’re doing,” Jose emphasized. “From target discovery to synthetic biology, the ability to merge data science with life science tools is unlocking real platform value.”

This convergence—life sciences x AI—is a particular focus for Phase Two, and a major reason why San Diego is so well-positioned. With UCSD’s strengths in bioinformatics, local startups pushing the edge of AI-driven R&D, and a track record of spinning out science-first companies, the region is ripe for a new wave of platform company formation.

What’s Next for Phase Two?

Right now, Phase Two Ventures is raising capital for its first fund and selectively investing in companies that align with its thesis: life science tools and platform technologies with AI integration and global-scale potential.

But it’s also investing in people.

That includes founders who are spinning out of San Diego labs with world-class training but limited exposure to venture formation. It includes operators who want to stay in Southern California and contribute to homegrown success stories. And it includes fellow investors, family offices, and ecosystem builders who want to co-invest in the next generation of biotech greatness.

Events like this one—standing-room only, buzzing with serendipitous connections—are just one part of how Phase Two intends to keep momentum high.

A Word on Partnership

The event’s success would not have been possible without JL (JLL), who provided the space and support to host such a dynamic group. Partners Grant Chan and Damon from JLL have been instrumental in helping local biotech companies find the space they need as they scale.

And Cooley, a longtime leader in legal support for biotech and venture-backed startups, continues to anchor the legal side of the ecosystem with deep expertise and founder-friendly structures.

Both firms exemplify the kind of ecosystem partners that Phase Two champions: ones who show up, stay engaged, and share the belief that San Diego’s best days are still ahead.

A Toast to the Long-Term

“We’re in this for the long haul,” Jose wrapped up. “This isn’t about quick flips or chasing headlines. It’s about backing serious science, exceptional teams, and building enduring companies.”

There was no need for a mic drop—just the hum of conversations picking up, laughter echoing through the room, and hands reaching across tables to make new connections.

The kind of night that reminds you: if you believe in the future of biotech, this is where it starts—among the people bold enough to build it.

Get Involved

If you’re a founder working on life science tools or AI-driven biotech, Phase Two wants to hear from you.

If you’re an investor looking to deploy capital into mission-driven companies with world-class science and regional stickiness, Phase Two invites your partnership.

And if you just want to be part of something meaningful happening in San Diego, stay tuned. This was just one of many more events to come.

San Diego’s life science future doesn’t need to be built elsewhere. It’s happening here. Right now. And Phase Two is helping lead the charge.

I love reading profiles like this—San Diego has long been a powerhouse in life sciences, and it’s inspiring to see local founders and operator investors working to strengthen the early-stage ecosystem. The energy and commitment to keeping innovation rooted here are contagious.